There may never be a better time to create a charitable lead trust

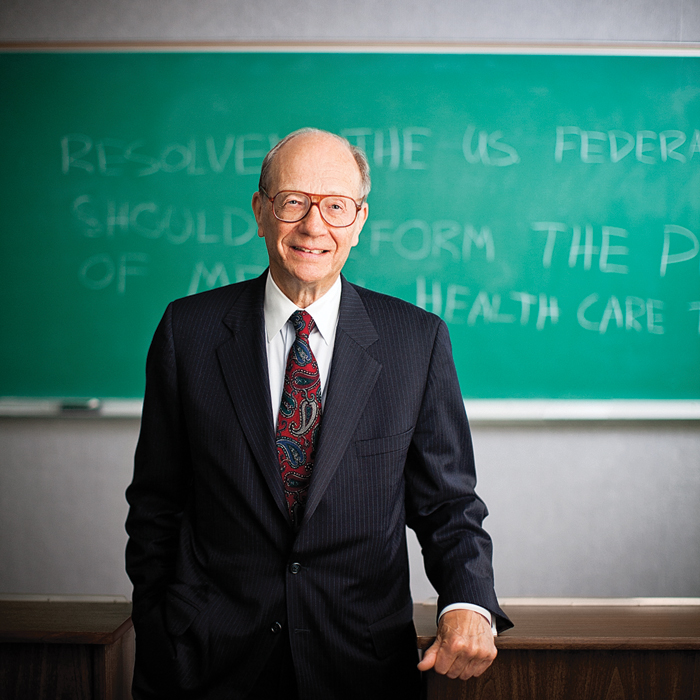

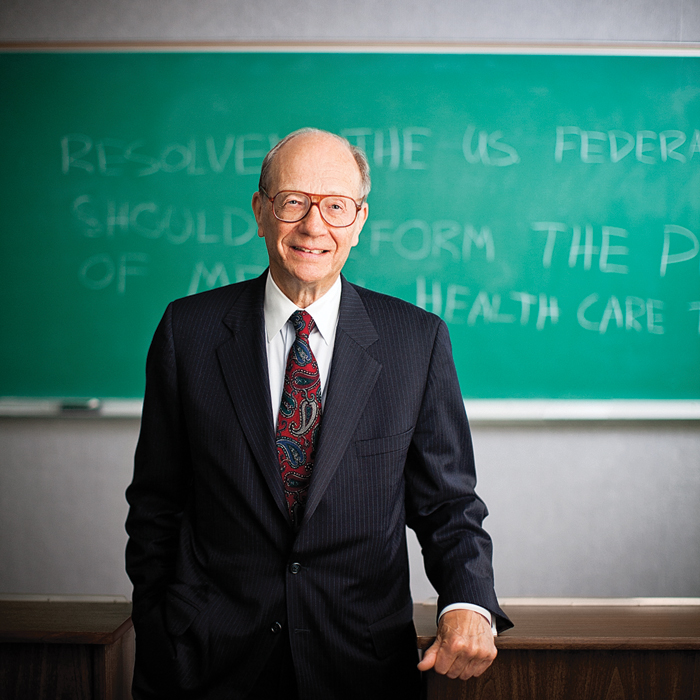

When it comes to charitable lead trusts, McGaffey knows what he’s talking about.

With interest rates so low, according to UNL alum Jere McGaffey (’57), there may never be a better time to create a charitable lead trust.

“The lower your interest rate is, the greater the value of the charitable interest; therefore, the greater the amount of the deduction for gift tax purposes,” he says. “And we’re probably at an all-time low for interest rates. That’s what makes it so advantageous now.”

When it comes to charitable lead trusts, McGaffey knows what he’s talking about.

The Wisconsin tax attorney once chaired the American Bar Association’s Tax Section, an organization with more than 20,000 members, and received its highest honor in the Distinguished Service Award. He once chaired the American College of Tax Counsel, an organization of about 600 tax lawyers chosen for their reputation. He was the first attorney to receive an award as the outstanding tax professional in Wisconsin.

He’s also a donor – one who created a charitable lead trust with his own money to help support the debate team at the University of Nebraska–Lincoln.

He debated in college. That experience changed his life. It taught him how to outline, research, do analysis and organize his thoughts. It put him on the right career path, which led through Harvard Law School. It honed his speaking skills and helped him become a nationally renowned speaker on tax issues. That’s why he wanted to give back to UNL debate.

And a charitable lead trust, he says, was the perfect way for him.

“I wanted to make sure debate continues, so I support it through a charitable lead trust,” he says. “A charitable lead trust is a very effective way to make a gift because you establish a trust that gives a certain amount of money every year, for a certain number of years, and then it goes to your children or grandchildren.

“It’s a way you can see in your own lifetime what good your money has done – and I have. I return to Lincoln sometimes to attend the debate team’s banquets. It’s nice to see young people so enthusiastic.”

A charitable lead trust provides for a percentage of the annual value of the trust or a designated amount to be paid to a charity every year. The present value of the payments to the charity reduces the amount otherwise subject to estate or gift tax. After the period of giving to the charity, the trust assets go to the donor’s descendants.

A charitable lead trusts is often established upon a person’s death rather than during a person’s life. But it also has great advantages to donors if they do one while they’re alive, McGaffey says. In his case, he’s been able to see how well the university has handled the funds.

For people who plan to make a larger gift upon death, he says, making a gift during life lets them observe how the charity is going to handle the gift.

Another advantage: When a person establishes a charitable lead trust while they’re still alive, the clock starts ticking and it’ll be that much sooner until their heirs receive the money.

“I had one client planning on doing this at the time of his death, but he decided, ‘Well, look, if I can afford to do this now, it will be that much sooner that the money will go to members of the family.'”

A charitable lead trust also is a good idea, he says, because it benefits charity.

“I’ve been able to see the debate program grow and do better over the years,” he says. “I get contacted as to what’s happening in the program. I get back once a year to see what’s going on and talk with the people there.

“It’s a very satisfying thing to be able to see that your money is doing some good.”

For more information on establishing a charitable lead trust with the University of Nebraska Foundation, please contact Tracy Edgerton or Megahn Schafer or call 800-432-3216.